What are the current fuel tax rates?

The current fuel tax rates are as follows:

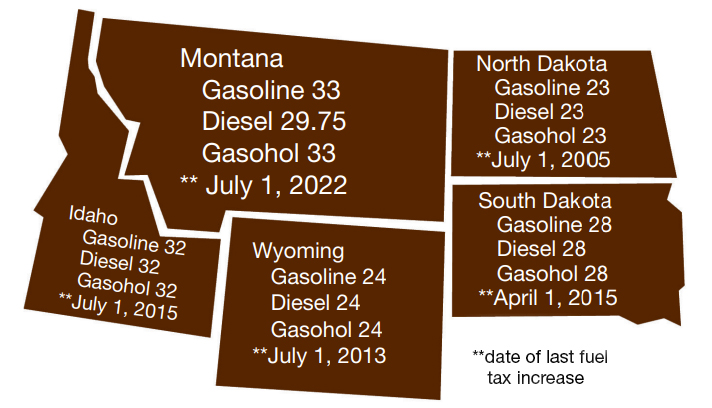

Table 1.1 - Fuel Tax Rates - Effective 7/1/22

| Fuel Type | Tax Rate | Montana Law |

|---|---|---|

| Gasoline (includes Ethanol & Ethanol Blended Gasoline) |

$.33 | 15-70-403 (1) (a) |

| Special Fuel (includes Biodiesel) |

$.2975 | 15-70-403 (1) (b) |

| Aviation Fuel (includes Avgas & Jet Fuel) |

$.05 | 15-70-403 (1) (c) |

Where do I get the forms to become licensed as a gasoline or special fuels distributor?

Forms are available on our forms page, or call the Motor Fuel Section at 406-444-0806.

How do I apply for an off-road fuel refund?

Applications and instructions are available on our forms page (see Fuel Tax section).

How are fuel taxes allocated to Montana cities and counties?

That information is covered in Questions & Answers about Fuel Tax Allocations.

Biodiesel

What is Biodiesel?

Biodiesel is a fuel produced from monoalkyl esters of long-chain fatty acids derived from vegetable oils, renewable lipids, animal fats, or any combination of those ingredients. The fuel must meet the requirements of ASTM D6751, also known as the Standard Specification for Biodiesel Fuel (B100) Blend Stock for Distillate Fuels, as adopted by the American society for testing and materials. MCA 15-70-401 (3) Biodiesel is not the same thing as raw vegetable oil. It is produced by a chemical process that removes the glycerin from the oil.

Is Biodiesel Taxable?

Yes. Biodiesel falls under the definition of Special Fuel MCA 15-70-401 (21). A person who engages in the business in this state of producing, refining, manufacturing, or compounding gasoline or special fuel for sale, use, or distribution is considered a “distributor” and must be licensed as such. MCA 15-70-401 (8).

This applies to all persons regardless of the amount they produce or manufacture, or if their intent is for personal use only. Every gallon of fuel used to propel a motor vehicle upon the highways, roads and streets of Montana is taxable.

Are there any Biodiesel Fuel Tax incentives?

Yes. MCA 15-70-433: Provides a refund of 2 cents per gallon to licensed distributors and 1 cent per gallon to retailers who sell Biodiesel that is produced entirely from Biodiesel ingredients produced in Montana. The refunds must be applied for within 30 days after the quarter ends.

Are there any Biodiesel Fuel Tax exemptions?

Yes. MCA 15-70-405: If the special biodiesel is produced from waste vegetable oil feedstock; special biodiesel fuel producer shall register annually with the department and report on the amount of biodiesel produced and used by the producer in a calendar year by February 15 of the succeeding year.

Dyed Special Fuel

What is Dyed Special Fuel?

Special Fuel that has dye injected at a terminal is exempt from tax. Dyed special fuel is for off road use, may be used by governmental agencies, and may be used in Off-Highway Vehicle/Equipment. MCA 15-70-403 (3) Montana Administrative Rule (ARM) 18.15.502. Special Fuel dyed by any other means such as “splash blending” is not considered exempt from tax (unless the mechanical injection system is inoperative). ARM 18.15.504 (7).

What are the consequences for using dyed special fuel in a motor vehicle on the public roads and highways of this state?

MCA 15-70-441 (1) (b) (ii) and 15-70-443

Effective October 1, 2005, the penalties for using dyed fuel on public roads in Montana are:

- 1st offense – $1,000.00 – Civil Penalty

- 2nd offense – $5,000.00 – Civil Penalty

- 3rd and subsequent offense – Criminal Penalty – $1,000.00 or by imprisoned in the county jail for not to exceed 6 months, or both.

Ethanol-blended gasoline

What is Ethanol-blended gasoline?

Ethanol-blended gasoline is a gasoline fuel that is blended with denatured ethanol. The percentage of ethanol in the blend is identified by the letter "E" followed by the percentage number. A blend that is 10% denatured ethanol and 90% gasoline would be reflected as E-10. A blend that is 85% denatured ethanol and 15% gasoline would be reflected as E-85. MCA 15-70-401 (10)

Montana Petroleum Storage Cleanup Fee

What is the Montana Petroleum Storage Cleanup Fee?

A fee of $.0075 is collected on each gallon of gasoline, special fuel, dyed special fuel, aviation, and jet fuel. This fee is collected by the Montana Department of Transportation (MDT) and then sent to Department of Environmental Quality (DEQ) for leaking storage tanks. The Petroleum Tank Release Compensation Board, administratively attached to DEQ, oversees the payout of these funds to qualified owners of leaky tanks that require clean up per §75-11-301, MCA.

Who is exempt from paying the Montana Petroleum Storage Clean up Fee?

The cleanup fee works exactly like the tax except for a few exemptions. The last licensed distributor in the chain is responsible to pay the tax and cleanup fee. If one licensed distributor sells to another licensed distributor, the burden of tax and cleanup fee is passed on to the next licensed distributor.

If a licensed distributor exports any fuel directly from the terminal out of Montana, the clean- up fee is not assessed. However, if the fuel has come to rest in any storage tanks in Montana, and then later is exported out of Montana, the cleanup fee is due because that fuel has rested in a storage tank. Retail owners of storage tanks in Montana have the benefit of applying to the DEQ for costs of cleanup due to leaking underground storage tanks.

Only those gallons of JP4 or JP8 (jet fuel) that are sold directly to the Military Defense Fuel Supply Center are exempt from the cleanup fee. This is because the military has agreed to bear the costs of any leaking underground storage tanks that they own. JP4 is not manufactured anymore. It has been replaced by JP8.

Also, special fuel sold to the Military or sold to the Railroad is also exempt from the cleanup fee. Montana’s railroad companies have agreed to pay for any cleanup costs due to leaking underground storage tanks.

Any fuel that comes to rest in a storage tank in Montana (other than one owned by a railroad company or the military) is subject to the cleanup fee. MCA 75-11-301

For more information on the Petroleum Storage Cleanup Fund, please visit DEQ's website.

Distributors

Do I need a license to buy and sell fuel in Montana?

No. A person must qualify for the license by engaging in one or any of the following activities:

- The business of producing, refining, manufacturing, or compounding gasoline or special fuel for use, or distribution; or

- Importing from another state or province;

- Exporting fuel from Montana to another state or province;

- Engaging in the business of wholesale distribution of gasoline or diesel and CHOOSES to become licensed to assume the Montana state gasoline and/or special fuel tax liability. See ARM 18.15.210 and 18.15.211

- Grand-fathered (licensed prior to 1969)

- A blender of ethanol (alcohol) and gasoline MCA 15-70-401(10) and 15-70-503(3); See ARM 18.217

What is the purpose of a distributor’s license?

In Montana, the taxation point of gasoline, aviation fuel and diesel fuel is “at distributor level”. This means the licensed distributor is the collector of the state tax for MDT. The license allows the distributor to purchase fuel at the terminal without the tax and cleanup fee included in the price. Terminals, Refineries, Blenders, and Importers are required to have the license because they have access to fuel that has not yet been taxed (from the pipeline, by producing fuel, and by importing from another state). Licensed exporters buy the fuel in Montana and then leave the state.

If the distributor is not a refiner, terminal, importer, exporter, not licensed prior to 1969, or does not blend alcohol with gasoline, but qualifies as a wholesaler; they may CHOOSE to become licensed under the wholesaler option. READ THE WHOLESALER DEFINITION IN MCA 15-70-401 (8) (a) (iii); See ARM 18.15.210 – 18.15.211 As it says in 18.15.210, to be qualified as a wholesaler, the distributor must supply fuel in bulk quantities to retail outlets that are not owned by the distributor.

If the tax is $0.33 on gas and $0.2975 for special fuel, why does the distributor pay $0.3267 on gas and $0.2945 on special fuel?

All licensed distributors receive a collection allowance in the amount of 1% on gasoline and special fuel. There is no collection fee on aviation fuel. MCA 15-70-410(1)

Do I need a separate license for each type of fuel I want to distribute?

No. A distributor needs only one license. The tax reporting form includes all fuel types that are taxable.

Do I need a separate license to import or export?

No. Once a person qualifies as a distributor, he is able to engage in all the activities defined for a distributor. MCA 15-70-401(8) (a) (ii) and (14) and (15)

Can I buy clear fuel then add dye to be exempt from tax?

No. To be exempt from the tax, diesel must be injected with dye at a refinery or terminal. MCA 15-70-403; See ARM 18.15.504 (6).

As a licensed distributor, what amount of surety bond is required?

A distributor must post a bond equal to not more than twice their estimated monthly tax liability. MCA 15-70-402 (b) (i);

The minimum bond amount for a distributor who imports or exports is $25,000.00. MCA 15-70-402 (b) (ii); the maximum amount the department can require is $100,000.00. See ARM 18.15.202

As a licensed distributor, how often do I need to file?

Distributors file monthly, even if they do not have activity during the month. MCA 15-70-410

What is the due date for distributor’s tax report and payment?

The due date for the report and payment of the tax is the 25th of each calendar month following the actual month the distributor distributed the fuel. If the distributor pays his taxes by electronic funds transfer, the payment due date is 5 days after the 25th of the month. The due date for the tax return remains as the 25th. Anytime the due date falls on a weekend or holiday, the due date is the first business day after the 25th. MCA 15-70-410; and 15-70-113.

If I have a problem and am not able to file a tax return on the due date, am I allowed an extension to pay the tax due or file my report?

No. There is no provision in the law for an extension of either paying the taxes or filing a tax report. There have been some instances where a distributor had problems with their computers. The best thing to do is estimate the best you can and pay and file on the due dates. Distributors can amend their reports and can get credit they have overpaid. MCA 15-70-410; and 15-70-425.

What is the penalty for late filing and/or late payment?

The late filing penalty is $100.00. The first late filing penalty within a 3 year period may be waived if a distributor has a clean filing history. MCA 15-70-417(3)(a)

Late payment of tax is charged 10% penalty on the balance owing and bears interest at the rate of 1% on the tax due for each calendar month prorated daily. MCA 15-70-417. There is no waiver of penalty or interest on a late payment of tax.

Do I have to re-license every year?

No. The license is good until canceled or revoked.

Is there a fee to become licensed?

No.

Who is exempt from paying the Gasoline license tax?

Licensed distributors pay the gasoline license tax to the Department of Transportation. The motor fuel tax is then passed down to the customer or ultimate consumer. There are no exemptions for paying the gasoline tax. However, the gasoline tax may be subject to refund or credit if conditions are met as stated in MCA 15-70-425.

Who is exempt from paying the Special Fuel license tax?

SEE DYED SPECIAL FUEL

Licensed distributors pay the special fuel license tax to the Department of Transportation. The motor fuel tax is then passed down to the customer or ultimate consumer. City, state and federal governments may use untaxed dyed special fuel upon public roads or may apply for a refund of the taxes paid on special fuel regardless of the use of the special fuel. MCA 15-70-425 and ARM 18.15.503

Who is exempt from paying the Aviation Fuel license tax?

Only those gallons of JP4 or JP8 (jet fuel) that are sold directly to the Military Defense Fuel Supply Center are exempt from the total .04 tax. MCA 15-70-403 (1) (c)

What are the consequences of importing fuel into MT without a license?

Failure to obtain a Montana Gasoline/Special Fuel Distributor License as required, subjects the distributor to the provisions of MCA 15-70-419 allowing for the seizure, confiscation, and possible forfeiture of the fuel.