Overview

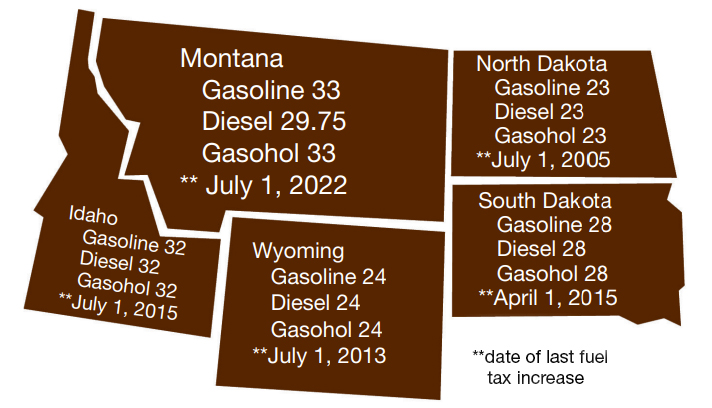

Every time you fill your vehicle, motorcycle, truck, or airplane in Montana, the price per gallon of fuel includes fuel taxes. Those taxes are collected and remitted to the state of Montana to support and maintain a safe transportation system.

Road & Bridge Funding in Montana

Montana’s roads and bridges rely heavily on a mix of federal and state/local funding, with about 88.5% of the funding coming from federal sources and 11.5% from state and local sources. Notably, the Montana Department of Transportation (MDT) does not receive any general fund revenue from the state for road maintenance; instead, it is funded principally through fuel taxes and related transportation fees.

Federal road and bridge revenues are generated from the users of our highways through gasoline and diesel fuel taxes and apportioned to states through federal highway legislation. State road and bridge revenues are generated through fuel taxes, gross vehicle weight fees, and other related fees.