What are impact fees?

Impact fees are charges imposed upon private land developers by a governmental entity to fund the additional service capacity required by the development for which it is collected (7-6-1602). Developers can also opt to donate land and/or build public infrastructure in lieu of cash payments.

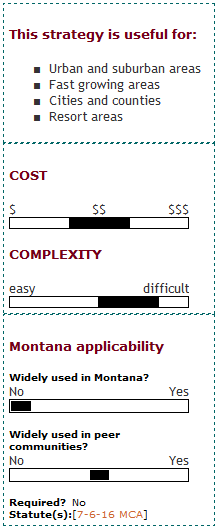

Impact fees are becoming increasingly popular as a method for financing transportation infrastructure needs in Montana and in other states. They can help local communities generate revenues for the development and extension of local street networks, transit stations, and bicycle/pedestrian facilities.

An impact fee can also serve as a strategy to implement growth management policies and plans. Special area regulations may be used to designate geographic areas where impact fees will be applied. Some communities allow developers to offset some of their anticipated impact fees costs by paying for traffic mitigation, transportation demand management (TDM) or traffic calming measures in order to benefit the livability of the community.

The state of Florida has recently been considering mobility fees, seen as the next generation of transportation financing. Mobility fees are essentially impact fees that are particularly sensitive to vehicle-miles traveled (VMT), which rewards developments that locate in or near urban centers and those that offer a balanced mix of uses with lower fees. Mobility fees also help to streamline concurrency at the local level. Unlike a conventional road impact fee, the mobility fee is tied to achieving an area-wide future condition, and therefore may be applicable to addressing existing deficiencies, such as a road segment with no sidewalk or a lack of frequent bus service. For example, the local government conducts an analysis of the existing pedestrian, bicycle and transit level of service, and determines each to be an E condition overall throughout the district. A set of improvements is identified to achieve a B level of service score for each mode and an area-wide overall score, and adopts that target in the Comprehensive Plan as the basis for mitigating the impacts of new growth.

Who can implement an impact fee?

Montana Code Annotated, Title 7, Chapter 6, Part 16 enables local governments to establish impact fees to help pay for roads, water, sewer, stormwater, parks, fire and police, library, and solid waste facilities. Fees are assessed by local governments according to a formula.

A governmental entity that intends to propose an impact fee ordinance or resolution must establish an impact fee advisory committee which includes at least one representative of the development community and one certified public accountant. The committee reviews and monitors the process of calculating, assessing and spending impact fees. Committee recommendations and comments are provided to local officials for reference during the development review process.

What are the keys to success and potential pitfalls?

Consistency: Impact fee ordinances must clearly identify the process and methods that a locality will use to require (or negotiate with) private sector developers to pay for public services or infrastructure needs triggered by new development. The geographic area that is subject to impact fees must be clearly defined, and the negotiation process must be consistently applied to all proposed developments in the designated area. Standards created to determine the amount of the exaction must be consistently applied across the board.

Clarity: The community must establish clearly defined level of service standards for the infrastructure and/or services to which the impact fee applied. The impact fee amount must be based upon a detailed analysis of existing and anticipated future conditions and capital improvements required in order to maintain the locally established standards. The fee cannot be used to support operational or maintenance improvements, or to correct deficiencies in the existing system. In addition, new development may not be held to a higher level of service than existing development unless there is a mechanism in place for the existing users to make improvements to the existing system to match the higher level of service.

Education: One key to successful implementation of impact fees is community education and stakeholder awareness of how the fees support infrastructure for the community as well as the developer. Implementing a public education campaign around impact fees could allow more support within the community. Developers should also be provided with a detailed accounting of what the impact fee will be used for, and how it is calculated.

Several concerns may arise when the idea of impact fees is proposed for the first time. Proactive, thoughtfully developed information can help decision-makers weigh the pros and cons, and can dispel "myths." For example, communities concerned about losing economic development worry that the "de facto" tax implied by impact fees could cause job growth to slow down, or drive developers to other communities that don't have impact fees. Another argument that has been made against the use of impact fees is that they may have an effect on the price of housing or other units by increasing it. The use of the impact fee on developers may cause them to pass the cost onto the property owners and charge them a higher cost due to the extra fee they will have to pay.

Coordination: There is significant up-front work in establishing how to assess impact fees, and regional coordination is needed to ensure that communities within the same region have comparable requirements so that developers are less able to play one community off another.

Contingency: All impact fee revenues are dependent upon growth, and are therefore cyclical and subject to the current economic climate. Impact fees are not an overly stable source of revenue. Although impact fees provide funding for new capacity, funding sources for backlogs, operations and maintenance may still be needed. Other funding avenues should be sought after.

Where has this strategy been applied?

Examples in Montana

- City of Missoula

- City of Livingston

- Gallatin County

- City of Bozeman: As of January 2009, impact fees had funded part or all of nearly 20 major expansions to the water, sewer, and street systems of Bozeman. Several additional projects were scheduled for impact fee funding in the next several years including major expansions of the sewer service area and widening of two key arterial streets.

Montana communities considering impact fees:

- The City of Whitefish is considering impact fees.

- The City of Polson adopted impact fees for parks, water, sewer, fire in 2007

- The City of Hamilton adopted impact fees for water, sewer, fire and police.

- The City of Belgrade adopted impact fees for parks, water, sewer, streets, and fire in 2007.

- The City of Columbia falls has water and sewer hook-up fees and may consider road impact fees at some time in future.

- The Town of Manhattan has water and sewer impact fees and is considering adding impact fees for streets and fire services.

- Ravalli County is considering an impact fee program.

- City of Kalispell Impact Fee Debate: On March 2009, Kalispell adopted an impact fee program after two years of trying to come up with a workable policy while developers criticized the fees as unfair to retail and commercial development (some projects would be required to pay millions of dollars), and possibly out of line with state law. In the end, the Kalispell City Council approved the motion 8-1.

The deteriorating economy and attendant slowdown in new construction heightened the urgency of this issue for both the city and the business community. Kalispell had a list of roughly $12 million in road improvements and upgrades listed in its Capital Improvement Plan, for which the city intended to charge new developments through traffic impact fees. But in discussions, it grew clear to council members that the charges on developers would not cover the entire cost of these projects. Since the city lacks the funds to complete some of these road improvements, it was unclear how some of the projects could ever be completed.

The council also needed to decide on a policy to "grandfather" developments with phases already under construction for which financing had already been arranged. Developers argued that introducing a large fee after developments had already been approved represented a "bait-and switch" on the city's part, and could fail to make many proposed projects profitable.

Examples outside of Montana

- The City of Lacey, Washington rewrote the ordinance governing collection of fees to mitigate development impacts on the transportation system. The revised ordinance includes trip generation reductions for commercial property and a per trip mitigation fee cap for residential properties.

- The City of Alexandria, Virginia, has developed an ordinance that requires projects meeting certain size thresholds to submit traffic impact analysis and transportation management plans (TMP). The ordinance requires the establishment of a TMP fund to finance TDM strategies that will induce people to use public transit.

- Florida's Model Fair Share Ordinance is intended to mitigate the impacts of developments on transportation facilities through the cooperative efforts of the public and private sectors. While the model ordinance focuses primarily on improvements to the street network, it does allow for the improvement of transit facilities to offset impacts. In the case of the Florida model ordinance, developers can receive credits against their fair-share ordinance payments for any impact fees they pay.

- The City Engineering Department of Fort Collins, Colorado uses standards from its adopted Master Street Plan Network and functional classification of streets to determine "street oversizing" impact fees. Street oversizing fees are determined in part by the number of lanes and miles reflected on the planned street network. Fees are calculated for all streets, collector level and above. These fees are revisited on a regular basis and recalibrated depending on changes to the Master Street Plan network.

- Mobility fees were explored in Tarpon Springs, Kissimmee and Pinellas Gateway Multimodal Transportation Districts (FL) based on the anticipated amount of future development occurring within the district or sub-district boundary, and the cost of multimodal mobility strategies to achieve quality and level of service targets in a horizon year.

Case studies

How can I get started?

A first step in determining whether the local community should set up development exactions and impact fees is to meet with local developers to see what tools would be acceptable for them. Having initial discussions to gauge receptiveness from potential developers, current real estate managers, and representatives from the business community is critical in future success of tool implementation. If the reception towards this tool is weak or minimal, the community may want to pursue other smart transportation and land use tools.

Where can I get more information?

- Impact Fees and Housing Affordability: A Guide for Practitioners: The purpose of this guidebook is to help practitioners design impact fees that are equitable. Prepared for the U.S. Department of Housing and Urban Development, the guide steps through how a fair impact fee program can be designed and implemented. In addition, it includes information on the history of impact fees, discusses alternatives to impact fees, and summarizes state legislation that can influence the design of local fee programs. There are also case studies of successful programs

- Field Guide to Development Impact Fees: Published by the National Association of Realtors, this web site includes articles, studies, Supreme Court decisions and other material on the debate over impact fees

- Florida Mobility Fee Study (2009): The potential policy and practical implications of implementing mobility fees and transportation utility fees in Alachua County, FL are discussed in this report. Valuable background information is presented on mobility fees.

- ImpactFees.com: Maintained by Duncan Associates, this site is a comprehensive and current collection of online information relating to impact fees and infrastructure financing. This site includes surveys of national and regional practice related to impact fees, links to impact fee statutes, and reports and fee schedules for county and municipal governments across the country.

- National Impact Fee Roundtable: This information exchange forum provides information on impact fees as an infrastructure finance tool. It includes access to a discussion listserv and links to external reports related to impact fees across the country.

- Impact Fees in Missoula, MT: This site provides information on Missoula's transportation impact fee, including a link to the 2007 Transportation Impact Fee Study.