What is Tax Increment Financing?

Tax Increment Financing (TIF) is a technique that allows a local government or redevelopment authority to generate revenues for a group of blighted properties targeted for improvement, known as a TIF district. As improvements are made within the district, and as property values increase, the incremental increases in property tax revenue are earmarked for a fund that is used for improvements within the district.

Expenditures of TIF-generated revenues are subject to certain restrictions and must be spent within the district. The funds generated from a new TIF district could be used to finance projects such as street and parking improvements, tree planting, installation of new bike racks, trash containers and benches, and other streetscape beautification projects within the designated area.

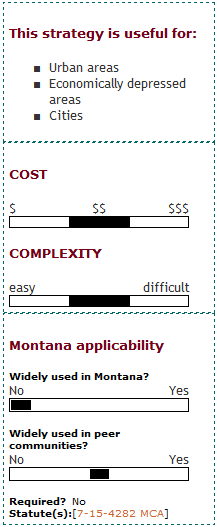

In Montana, TIF districts were authorized in 1974 and are assessed through property tax. Financing options include private activity revenue bonds, pay as you go, loans, special assessments, and tax increment bonds.

Who can implement a TIF District?

State enabling legislation gives local governments the authority to designate tax increment financing districts that lasts 20 or more years, or enough time to pay back the bonds issued to fund the improvements. While arrangements vary, it is common to have a city government or redevelopment authority assume the administrative role for the financing district, making decisions about how and where the tool is applied.

What are the keys to success and potential pitfalls?

Market Conditions: TIF districts work well with large, expensive projects that promise quick and substantial spikes in the tax increment. Government-owned (tax exempt) property, abandoned buildings, derelict sites in appreciating neighborhoods, and projects in locations that have recently been "upzoned" (i.e. approved for higher densities and/or more mixed uses) are prime candidates for TIF-financed infill development.

Rising Property Values: Although tax increment financing is a useful alternative to publicly funded community improvement programs, some question whether TIF districts benefit the local population in the long term. The program depends upon increased real-estate values and associated increased property tax revenues. However, this can easily lead to "gentrification" by making the neighborhood unaffordable to existing residents and business. Stakeholders such as small business owners, renters, and elderly or low-income homeowners may feel threatened by proposals for large scale TIF-funded development, as they may not be prepared for the higher tax burden generated by the intended higher property values. To ensure that TIF does not cause displacement of existing residents, local government should put establish protections such as property tax deferral programs for groups at risk for displacement.

Carefully Defined District Boundaries: TIF districts do not generate funds for incentives or infrastructure immediately; instead increments trickle in over the lifetime of the district. The local government must, therefore, find ways of paying for the up-front costs of any initial improvements. For example, a designation as "blighted" can allow governmental condemnation of property through eminent domain. However, it is very important to clearly define the blighted area and to assess its potential for redevelopment without TIF. Sometimes TIF districts are drawn too large, encompassing property whose value would have increased anyway.

Demonstrated Public Benefit: An argument sometimes brought against the idea of TIF districts is that public funding is, for all intents and purposes, subsidizing private developers for profit-making ventures. The community is taking a financial risk in undertaking a TIF district, as there is potential for subsidized projects to not increase in value, or not increase rapidly enough. The community-wide benefit of the public investment in a TIF district must be clearly assessed, demonstrated and monitored over time.

Where has this strategy been applied?

Examples in Montana

- Helena Downtown TIF District Improvements: Tax increment financing has been used in many municipalities in Montana to generate revenue for public improvements projects. The City of Helena recently used TIF funds from its downtown district to finance streetscape enhancements on several blocks along one of its main streets and to conduct needed repairs on its downtown mall area.

- Missoula's Sawmill District: The 46-acre Champion Sawmill site, just west and across the Clark Fork River from downtown Missoula, sat vacant and contaminated for 15 years. TIF funding totaling $1.125 million covered nearly fifty percent of the costs of environmental remediation, clearing the way for the development of nearly 1,000 residential units, more than 150,000 square feet of commercial space, and a 15-acre park.

Examples outside of Montana

- Atlantic Station Steel Mill Redevelopment: Redevelopment of the 132-acre Atlantic Station Steel Mill, in Atlanta, Georgia, is the largest urban brownfield redevelopment in the United States. Environmental cleanup costs and infrastructure development were estimated to cost $187 million for the site, of which a substantial portion will be financed by TIF revenue. TIF funds are designated for use for environmental remediation, general site work, utilities, and transportation infrastructure. The TIF district was established in 2001, and generated over $8 million in revenue in 2006.

- Minneapolis Riverfront District Revitalization: TIF revenue has been used for a wide variety of purposes along the Minneapolis downtown riverfront since the 1970s. Some of these uses include the removal of incompatible land uses, removal of obsolete infrastructure, environmental remediation, development of transportation infrastructure, construction of the West River Parkway multi-use trail, creation of nearly 140 acres of new parkland, preservation and reuse of historic structures, and construction of the Guthrie Theater, Mill City Museum, nearly 5,000 new housing units, and over 4 million square feet of new office, commercial, and industrial space. Over half of the $300 million in public investment was funded through TIF.

- Dallas Area Rapid Transit (DART) TIF: A 559-acre TIF district was created recently that encompasses eight DART rail stations in Dallas, Texas. $328 million in TIF revenue is projected over the 30-year life of the TIF district, and revenues will be spent on public infrastructure such as streets, sidewalks, lighting, and landscaping. The goal of the TIF district is to encourage redevelopment of the station areas with walkable, mixed-use development.

How can I get started?

A first step toward creating a TIF district is to identify blighted areas that can be designated for improvement, and to conduct meetings with stakeholders and the general public to ensure that redevelopment plans will reflect local values and goals. Blight conditions and the TIF structure must conform to state statutes. Once the required conditions are met, the district may be formed by ordinance, which requires appropriate public notice and at least one public hearing. Once the district is designated, local governments and redevelopment authorities are given the power to engage in almost any kind of activity they believe would encourage private investment and enhance the property tax base of the area.

Where can I get more information?

- National Association of Realtors Guide to Tax Increment Financing. This document is an introduction to the process of Tax Increment Financing (TIF). The first section of the report is an introduction to the TIF process, including how the idea of TIF originated, the basic structure of a TIF program, and how TIF programs have operated in practice. The second section focuses on six communities that have used a TIF plan to fund projects in their areas. The final section is an analysis of TIF enabling legislation, including a chart of all state TIF enabling statutes, and a review of available TIF case law.

- TIF Resource Library. This website, run by the Council of Development Finance Agencies (CDFA), provides an extensive resource library on all aspects of TIF and other types of special assessment districts. Multiple reports are provided that summarize state-by-state experience along with case studies of individual TIFs.

- Montana Urban Renewal Law. This link provides access to enabling legislation for tax increment financing in Montana.

- TIF Districts. This website, run by Western Planning Resources, Inc., provides a brief overview of tax increment financing in Montana.